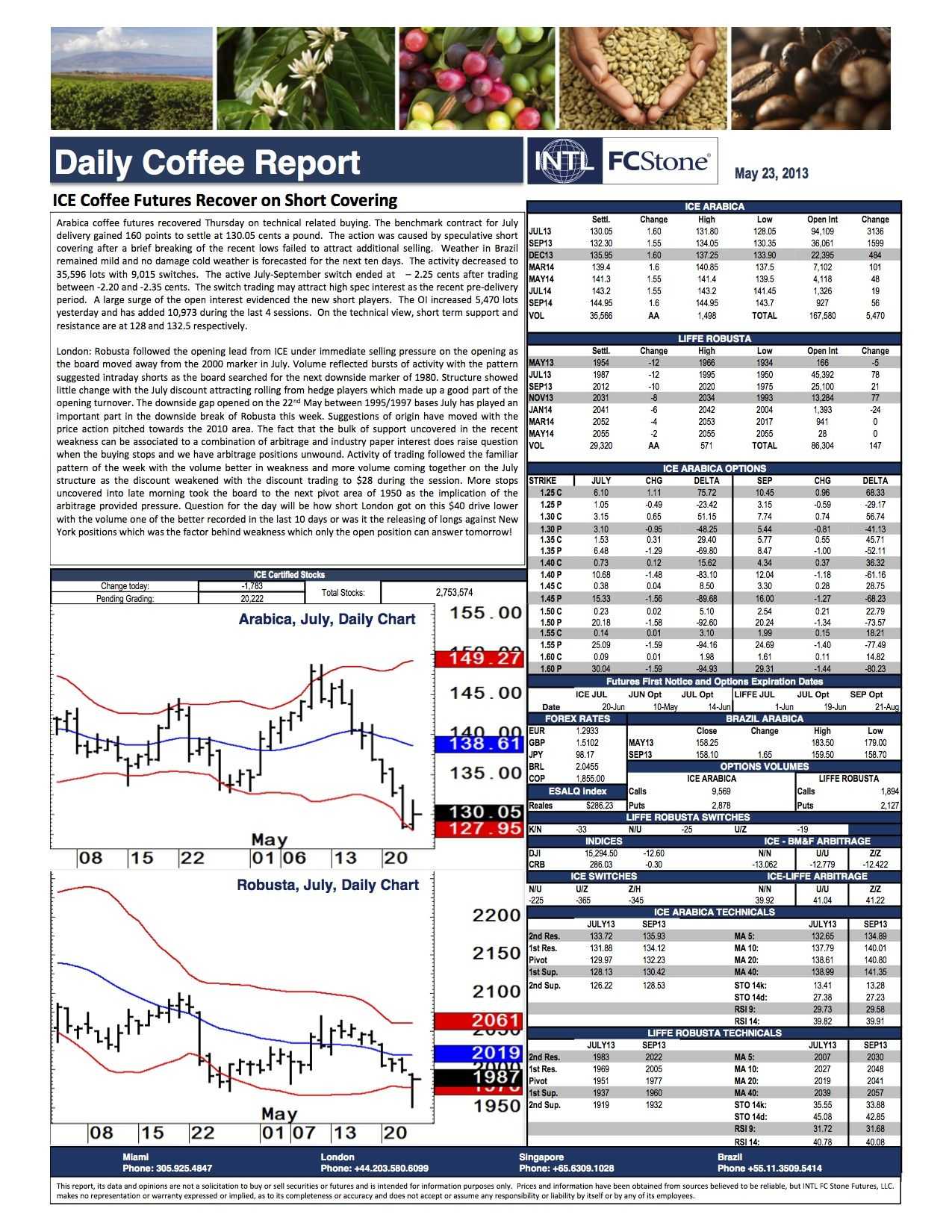

MILANO – Arabica coffee futures recovered Thursday on technical related buying. The benchmark contract for July delivery gained 160 points to settle at 130.05 cents a pound.

The action was caused by speculative short covering. After a brief breaking of the recent lows failed to attract additional selling. Weather in Brazil remained mild. No damage cold weather is forecasted for the next ten days. The activity decreased to 35,596 lots with 9,015 switches.

July-September: how the switch ended

At – 2.25 cents after trading between -2.20 and -2.35 cents. The switch trading may attract high spec interest. As the recent pre-delivery period.

A large surge of the open interest

It evidenced the new short players. The OI increased 5,470 lots yesterday and has added 10,973 during the last 4 sessions. Short term support and resistance are at 128 and 132.5 respectively.

Other informations from Ice

London Robusta followed the opening lead from Ice under immediate selling pressure on the opening; as the board moved away from the 2000 marker in July.

Volume reflected bursts of activity with the pattern suggested intraday shorts; as the board searched for the next downside marker of 1980.

And then, the structure showed little change with the July discount attracting rolling from hedge players; which made up a good part of the opening turnover.

The downside gap opened on the 22nd May

Between 1995/1997 bases July has played an important part in the downside break of Robusta this week. Suggestions of origin have moved with the price action pitched towards the 2010 area.

The fact that the bulk of support uncovered in the recent weakness can be associated to a combination of arbitrage and industry paper interest. It does raise question when the buying stops and we have arbitrage positions unwound.

Activity of trading followed the familiar pattern of the week with the volume better in weakness and more volume coming together. That’s on the July structure as the discount weakened with the discount trading to $28 during the session.

More stops uncovered into late morning

They took the board to the next pivot area of 1950 as the implication of the arbitrage provided pressure.

Question for the day will be how short London got on this $40 drive lower with the volume one of the better recorded in the last 10 days or was it the releasing of longs against New York positions; which was the factor behind weakness which only the open position can answer tomorrow!

POTETE SCARICARE QUI IL PDF.